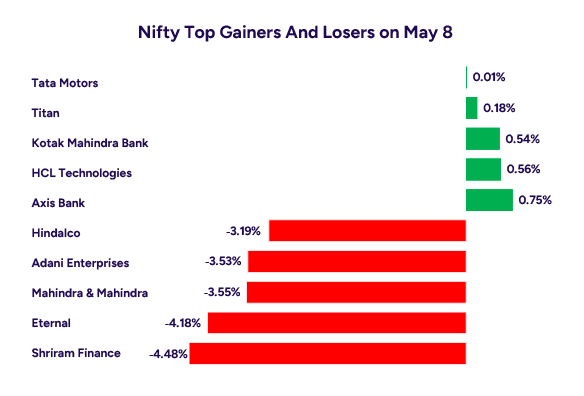

Nifty Top Gainers And Losers On May 8: Adani Enterprises, Adani Ports Rally; Kotak Mahindra Bank, ONGC Decline

- 8th May 2025

- 03:30 PM

- 2 min read

Mumbai, 8th May – Indian equities witnessed mixed trends on Tuesday, with select heavyweight stocks providing upside momentum even as financials faced pressure. The benchmark Nifty 50 index held steady amid range-bound trading, supported by strength in key Adani Group stocks and consumer-facing names.

Adani Enterprises Ltd., Adani Ports and Special Economic Zone Ltd., and Trent Ltd. emerged as the top gainers for the day. In contrast, Kotak Mahindra Bank Ltd., JSW Steel Ltd., and Oil & Natural Gas Corp. were the biggest laggards among Nifty 50 constituents.

Top Gainers and Losers

Key Triggers

- Adani Enterprises surged 7.03%, continuing its rally amid strong investor confidence in infrastructure and energy projects. The stock closed as the top gainer of the session, contributing significantly to Nifty’s gains.

- Adani Ports followed with a 6.31% jump, supported by rising port volumes and optimism around trade activity recovery, especially in the wake of stabilising global logistics.

- Trent Ltd. climbed 4.32% to ₹5,370.50, riding on sustained bullish sentiment in the retail segment driven by robust quarterly results and expansion plans.

- Shriram Finance added 4.24%, likely buoyed by improving asset quality and strong retail lending momentum.

- Bajaj Finserv advanced 3.63% amid renewed investor interest in diversified financial conglomerates.

- On the downside, Kotak Mahindra Bank slumped 4.59% to ₹2,084.90 after reporting a 14% YoY fall in net profit to ₹3,552 crore for the March quarter, driven by elevated provisioning for stressed microfinance loans.

- JSW Steel lost 1.82%, possibly due to weak metal prices and tepid export outlook. ONGC declined 1.73% to ₹239.20 as Brent crude dropped below $59 per barrel — the lowest since February 2021 — hitting revenue expectations.

- SBI and Axis Bank also ended in the red, losing 1.25% and 0.76%, respectively, on concerns about margin pressures and sector-wide provisioning worries.

Bottomline

Despite the underperformance of select banks and energy names, Nifty managed to stay afloat, powered by strength in infrastructure, ports, and retail counters. Adani Group stocks led the rally, reflecting sustained investor confidence. However, persistent weakness in financials like Kotak Mahindra Bank and global crude oil fluctuations kept overall market sentiment in check. With macroeconomic cues and earnings in focus, traders are likely to adopt a selective approach in upcoming sessions.